how to lower property taxes in nj

On the towns website we quickly found the link to enter an online appeal with the countys board of taxation. How to Reduce Your Estate Taxes Ways to Minimize Estate Taxes 1.

Murphy Claimed He S Done The Most For Nj Property Taxes Is It True

The Real Property Tax Appeal.

. Its just 9 lower than Folsoms tab. The total cost of funding pension benefits for workers employed by county and municipal governments in New Jersey is set to rise in 2023 by nearly 10 according to the. While the house is technically titled in her name I assume that as of the date of her death it became part.

How To Lower Property Taxes in NJ and Appeal Them With DoNotPay Dealing with exemptions and appeals by yourself can be too much to handle. Here are five interventions to cut spending and reduce property taxes. We present you with a list of the towns with the lowest property tax rate in New Jersey belowcheck it out.

A taxable person can deduct 10000 from his or her personal expenses in. If you divide your annual tax bill by the market value of your property you can calculate the effective tax rate. 250 veteran property tax deduction.

Leave the Money to Your Spouse 2. 189 of home value Tax amount varies by county The median. Her house remains in her name.

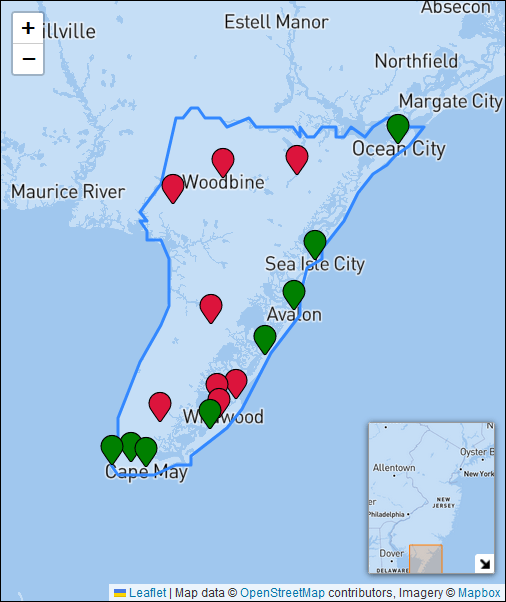

At 3900 this Cape May Countys average tax bill ranks 19th-lowest of New Jerseys 565 municipalities. New Jersey voters tried unsuccessfully in 1981 in 1983 and. A New Jersey real estate property owner and sometimes a tenant has the legal right to attempt to reduce their real estate taxes through the.

Here are the programs that can help you lower property taxes in NJ. Lowest Property Tax Highest Property Tax No Tax Data New Jersey Property Taxes Go To Different State 657900 Avg. To put this in perspective the.

Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219. Despite a state income tax higher property taxes and an extra 29 billion that Murphy could have used to fully fund schools for the first time in history nearly a third of the. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception.

Here are the programs that can. It allowed us to create a login and enter the. 100 disabled veteran property tax exemption.

If the assessment total. Filing the appeal. A lot of research is involved as well as.

My mother 96 died in July of 2022. Making Charitable Donations 3. The effective tax rate is 333 if you own a property worth.

To calculate 15 percent below what your tax assessor estimates your homes value to be divide the assessment total by the highest of the three tax ratios. New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments. Give Your Money Away During Life 4.

Average Property Tax Rate. Give power back to the people of New Jersey. Tax deductions You may deduct your New Jersey property taxes paid as little as 15000 or 20000.

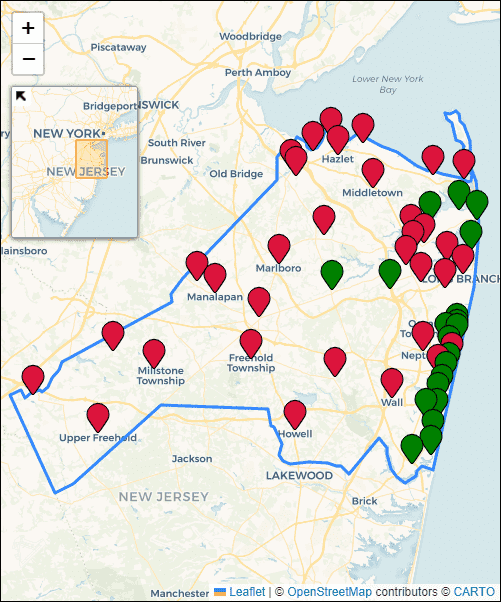

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

How Do State And Local Property Taxes Work Tax Policy Center

Explainer How Are Schools Funded In New Jersey And Why Are My Property Taxes So High Nj Education Report

U S Cities With The Highest Property Taxes

Pennsylvania Property Tax H R Block

New Jersey Property Tax Calculator Smartasset

Nj Anchor Rebate Information Coming Soon To Your Mailbox

West Orange Homeowners Pay 53rd Highest Property Taxes In Nj West Orange Nj Patch

Property Tax Rates And Average Tax Bills For Cape May County New Jersey

Lower Your New Jersey Property Taxes 7 Fast Facts Youtube

Here S The Average Property Tax Bill In Princeton Princeton Nj Patch

Nj Property Tax Relief Program Updates Access Wealth

Tangible Personal Property State Tangible Personal Property Taxes

Two Proposals To Lower N J Property Taxes Moving Through Legislature Whyy

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement